Efficient accounts receivable (AR) management is a cornerstone of a financially healthy healthcare practice. In an environment where timely reimbursements directly impact cash flow and overall operational success, healthcare providers must adopt robust strategies to manage AR effectively. In this blog post, we explore key challenges in AR management, provide actionable strategies for improvement, and highlight how technology can transform your billing processes.

Understanding the Importance of Accounts Receivable Management

Accounts receivable represents the revenue that a healthcare provider expects to receive from insurance companies and patients. When AR is not managed effectively, practices may face delayed payments, increased bad debt, and overall financial strain. Efficient AR management not only improves cash flow but also enhances patient satisfaction and reduces administrative burdens.

Challenges in Healthcare AR Management

Healthcare AR management is often complicated by various factors:

- Complex Billing Processes: Multiple coding systems and regulatory requirements can result in billing errors, leading to delayed or denied claims.

- Patient Payment Delays: Patients sometimes struggle with understanding their bills, resulting in late payments and increased collections efforts.

- Insurance Reimbursements: Variability in insurance processing and claim adjudication can further delay revenue collection.

- Administrative Overload: Manual processes and inefficient systems often lead to high administrative costs and resource strain.

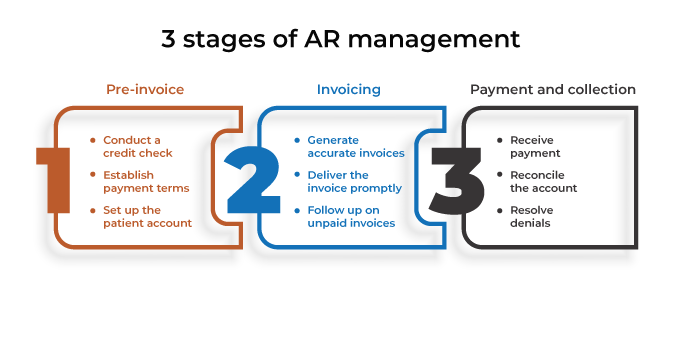

Strategies for Improving AR Management

Implementing effective strategies to address these challenges can make a significant difference in a provider’s revenue cycle. Here are some key approaches:

1. Automate Billing Processes

Automation is a game-changer for AR management. By integrating advanced billing systems, providers can:

- Reduce Errors: Automated systems minimize human errors in coding and data entry, resulting in fewer claim denials.

- Streamline Workflows: Automation accelerates the entire billing process—from claim generation to follow-up—ensuring faster revenue turnaround.

- Enhance Data Accuracy: Real-time validation and error checking help maintain the accuracy of billing records, reducing the need for costly rework.

2. Implement Clear Patient Communication

Patient understanding of billing procedures can significantly reduce delays:

- Transparent Billing Statements: Providing detailed, easy-to-understand billing statements helps patients understand their financial obligations.

- Payment Plans: Offering flexible payment plans and online payment options can encourage timely patient payments.

- Educational Resources: Educating patients on the billing process, insurance contributions, and any out-of-pocket costs can preempt misunderstandings and disputes.

3. Optimize Insurance Claim Processes

Insurance claims are a major component of healthcare AR:

- Accurate Coding: Ensuring that medical codes are correct minimizes claim denials and facilitates faster reimbursements.

- Regular Follow-Ups: Establishing a systematic follow-up process for unpaid claims helps identify and address issues promptly.

- Audit and Feedback: Regular audits of insurance claims can reveal recurring issues and inform necessary improvements.

4. Leverage Advanced Analytics

Data analytics can provide deep insights into AR performance:

- Identify Trends: Analyzing billing data can highlight patterns, such as common causes for delayed payments or frequent claim denials.

- Predictive Analytics: Advanced systems can forecast potential bottlenecks and allow proactive adjustments to billing processes.

- Performance Metrics: Tracking key performance indicators (KPIs) such as days in AR and claim denial rates helps monitor progress and refine strategies.

5. Partner with Expert Solutions

Healthcare providers often benefit from partnering with specialized companies that offer tailored AR management solutions. At InvoQuest, our expert team is dedicated to optimizing your revenue cycle through:

- Customized Billing Solutions: Tailored to meet the unique needs of your practice, ensuring smooth claim processing and accurate coding.

- Ongoing Support: Continuous training and support to keep your staff updated on the latest regulatory changes and billing practices.

- Advanced Technologies: Leveraging state-of-the-art software to automate workflows, enhance data accuracy, and reduce manual efforts.

Embracing Technology for a Brighter Financial Future

Investing in technology is not just about automating tasks—it’s about transforming your entire revenue cycle. Modern billing systems can integrate seamlessly with electronic health records (EHRs) and other practice management tools, providing a holistic view of your financial performance. This integration allows for:

- Faster Decision-Making: Real-time data access enables quick decision-making and proactive management of AR.

- Improved Cash Flow: Efficient AR management leads to faster collections, ensuring a steady cash flow for operations.

- Enhanced Patient Satisfaction: Streamlined billing processes reduce patient frustration and foster a more transparent financial relationship.

Conclusion

Effective accounts receivable management is essential for maintaining a healthy financial foundation in healthcare. By automating processes, optimizing insurance claims, communicating clearly with patients, and leveraging advanced analytics, providers can significantly reduce delays and improve their revenue cycle.

At InvoQuest, we are committed to helping healthcare providers navigate these challenges with innovative solutions. To learn more about how we can enhance your AR management, visit www.invoquest.us, call us at (888) 392-8990, or get in touch through our contact page today.

Leave a Reply